Some Known Incorrect Statements About Kam Financial & Realty, Inc.

Table of ContentsThe Best Strategy To Use For Kam Financial & Realty, Inc.Excitement About Kam Financial & Realty, Inc.Our Kam Financial & Realty, Inc. Statements3 Easy Facts About Kam Financial & Realty, Inc. DescribedUnknown Facts About Kam Financial & Realty, Inc.The Definitive Guide for Kam Financial & Realty, Inc.Not known Facts About Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Fundamentals Explained

If your regional area tax obligation price is 1%, you'll be charged a real estate tax of $1,400 per yearor a regular monthly real estate tax of $116. Lastly. We're on the last leg of PITI: insurance. Look, everyone that buys a house needs homeowner's insuranceno ifs, ands, or buts about it. That's not always a negative point.What an alleviation! Bear in mind that nice, elegant escrow account you had with your home tax obligations? Well, presume what? It's back. As with your real estate tax, you'll pay component of your homeowner's insurance coverage premium in addition to your principal and interest repayment. Your lending institution collects those settlements in an account, and at the end of the year, your insurer will draw all that cash when your insurance policy settlement is due.

Kam Financial & Realty, Inc. Can Be Fun For Anyone

It's implied to secure the lending institution from youwell, a minimum of from the opportunity that you can not, or simply level do not, make your home mortgage repayments. Naturally, that would never be youbut the lending institution does not care. If your down settlement is much less than 20% of the home's price, you're going to get put with PMI.

If you belong to a community like one of these, do not overlook your HOA fee. Depending upon the age and size of your house and the amenities, this could add anywhere from $50$350 to the amount you pay monthly for your total real estate expenses. There are many types of home mortgages and they all charge various regular monthly repayment quantities.

Things about Kam Financial & Realty, Inc.

Considering that you wish to obtain a home mortgage the wise method, get in touch with our good friends at Churchill Home mortgage - mortgage loan officer california. They'll walk with you every step of the method to place you on the most effective path to homeownership

The 20-Second Trick For Kam Financial & Realty, Inc.

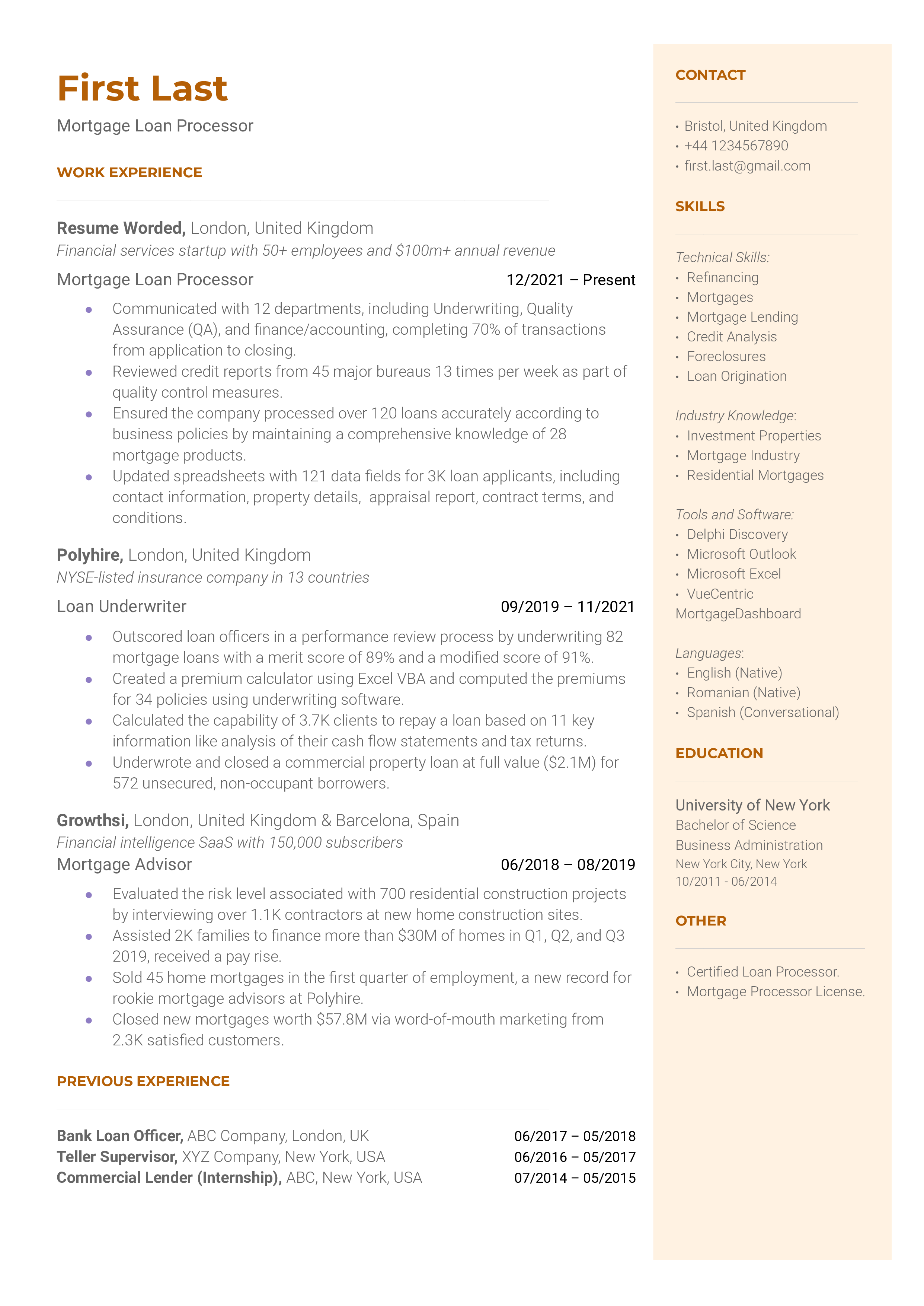

This is one of the most usual kind of mortgage. You can choose a term as much as thirty years with many loan providers. Many of the early repayments repay the interest, while a lot of the later payments pay off the principal (the initial quantity you borrowed). You can take a table finance with a set price of rate of interest or a drifting rate. (https://hearthis.at/kamfnnclr1ty/set/kam-financial-realty-inc./).

A lot of lenders charge around $200 to $400. This is typically negotiable. california loan officer.: Table lendings give the self-control of regular repayments and a collection day when they will be repaid. They provide the certainty of recognizing what your repayments will be, unless you have a floating rate, in which situation payment quantities can transform

Fascination About Kam Financial & Realty, Inc.

Revolving debt lendings work like a large overdraft. Your pay goes right right into the account and expenses are paid out of the account when they schedule. By maintaining the funding as low as possible any time, you pay less interest since lending institutions calculate passion daily. You can make lump-sum settlements and revise money up to your limitation.

Application charges on revolving credit home loans can be up to $500. There can be a charge for the daily banking deals you do via the account.: If you're well ordered, you can repay your home loan this content much faster. This also suits people with irregular income as there are no fixed repayments.

Kam Financial & Realty, Inc. for Dummies

Deduct the financial savings from the overall car loan amount, and you just pay interest on what's left. The more cash you maintain throughout your accounts daily, the much more you'll conserve, because interest is calculated daily. Linking as several accounts as possible whether from a partner, parents, or various other family members indicates even less rate of interest to pay.

Kam Financial & Realty, Inc. - Truths

Settlements begin high, however decrease (in a straight line) gradually. Fees are comparable to table loans.: We pay much less interest generally than with a table loan since early settlements consist of a greater repayment of principal. These might fit consumers that anticipate their income to go down, for instance, if one partner plans to give up work in a couple of years' time.

We pay the interest-only component of our payments, not the principal, so the repayments are reduced. Some debtors take an interest-only lending for a year or more and after that switch over to a table lending. The typical table financing application fees apply.: We have a lot more cash for other points, such as renovations.

Kam Financial & Realty, Inc. - Truths

We will still owe the sum total that we borrowed until the interest-only duration ends and we start paying back the car loan.

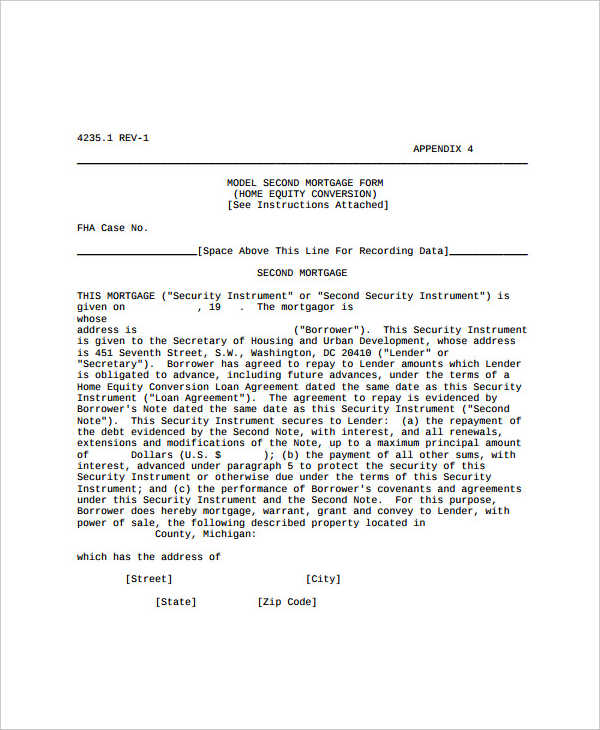

The home mortgage note is generally recorded in the public documents in addition to the mortgage or the action of trust and functions as proof of the lien on the home. The home mortgage note and the mortgage or action of count on are 2 various records, and they both offer different lawful functions.

Comments on “Not known Factual Statements About Kam Financial & Realty, Inc.”